Aggressive KiwiSaver Funds

If you’re ready to embrace a bold investment strategy with the aim of achieving the highest possible returns, aggressive KiwiSaver funds might be a fit for you. These funds are all about taking on high risk in exchange for high reward. They focus on high-growth assets and are designed for investors who are comfortable with market volatility and have a long investment timeframe.

What are Aggressive KiwiSaver Funds?

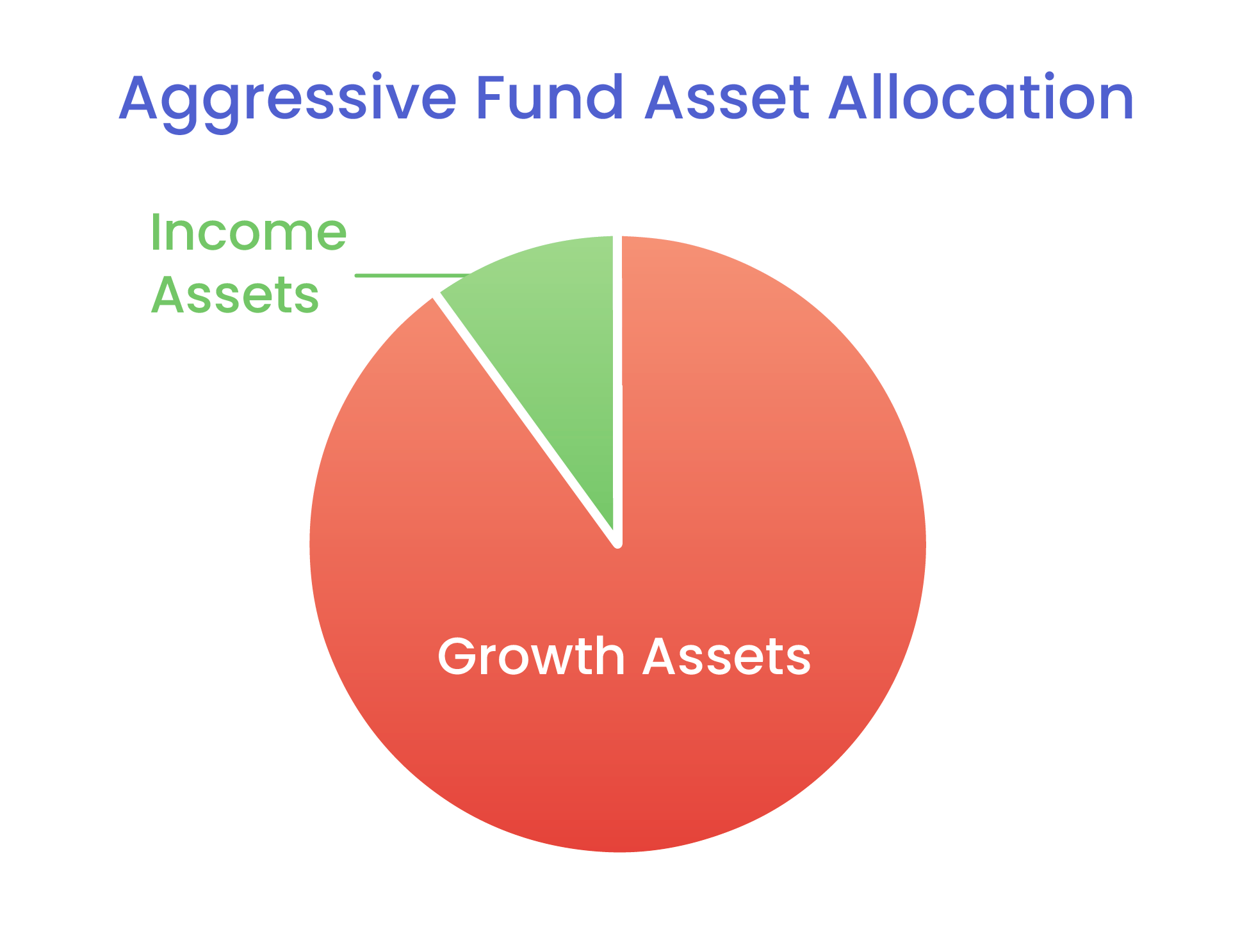

KiwiSaver funds consist of a combination of Growth Assets and Income Assets. The split between growth and income assets is adjusted depending on your chosen risk profile.

Income Assets: These low risk assets usually include cash and bonds. They are designed to provide regular income to your fund through interest payments, offering stability and consistent returns.

Growth Assets: These higher risk assets encompass shares and property. They aim to deliver capital growth over time, with returns that can fluctuate due to market conditions.

Aggressive funds are typically made up of 90–95% growth assets and 5–10% income assets. They focus on high-growth opportunities such as stocks in emerging markets, innovative technology sectors, and other fast-moving investment areas with the hope of achieving significant capital growth.

Who Should Consider Investing in Aggressive Funds?

High-Risk Takers: They suit those comfortable with significant market fluctuations and potential short-term losses.

Long-Term Investors: These funds are best for individuals who have a long investment horizon, typically at least 12 years, and can withstand the market volatility.

Those Seeking Maximum Growth: They cater to investors aiming to significantly grow their retirement savings, as with high risk often comes high reward.

To be a good match for an aggressive fund, you should identify with all three of these criteria.

Things to Watch Out For

Aggressive funds offer the potential for high returns, but they also carry substantial risks. The value of your investments can fluctuate significantly, and there is a possibility of notable losses, particularly in the short term. It’s important to be comfortable with this level of risk and have the patience to wait for potential long-term gains.

Before investing in an aggressive fund, ensure that you have a sufficient investment timeframe. Ideally, you should have at least 12 years before you need to access your funds to better weather the ups and downs of the market.

Determine Your Risk Tolerance

If you want to know whether an aggressive fund would suit your investment profile and timeframe, our KiwiSaver experts can run through a quick questionnaire with you, and get you into the right fund – free of charge. Get started.

Is your KiwiSaver fund performing as well as it could be?

Find out how your KiwiSaver fund compares.